Positives and negatives from Refinancing a house Collateral Mortgage

Lorraine Roberte is actually an insurance coverage author for the Equilibrium. Because an individual funds journalist, their assistance has currency administration and you will insurance coverage-associated information. She’s got written a huge selection of recommendations out-of insurance points.

Charlene Rhinehart is a specialist for the bookkeeping, banking, spending, a house, and private money. She actually is a beneficial CPA, CFE, Chair of your own Illinois CPA Community Private Tax Committee, and you may was thought to be one of Routine Ignition’s Top 50 people in the accounting. The woman is brand new creator out of Wealth People Day-after-day and you will an author.

A property collateral loan is a type of safeguarded mortgage taken on your property that enables one borrow secured on the property value your house. Furthermore called the second mortgage.

For those who have property guarantee mortgage however, wanted ideal prices otherwise various other terms and conditions, it is possible to re-finance. Discover more about how a house collateral mortgage performs and you can regarding the primary differences in refinancing options to bear in mind.

Key Takeaways

- You could potentially refinance a home guarantee mortgage, but you will must satisfy certification basic, such as with about 20% home equity and you may a credit reputation the lender welcomes.

- There clearly was several refinance possibilities, as well as a house security loan mod, a different domestic security loan, and you can mortgage integration.

- Examine the interest prices, terms and conditions, and you may costs of various fund before you choose the best re-finance alternative for your https://paydayloansconnecticut.com/dodgingtown/ home collateral mortgage.

- Refinance money will make a whole lot more feel when there will be monthly home loan percentage deals minimizing interest rates, and stay-in your property until your deals go beyond everything paid in settlement costs.

Who Qualifies To Refinance Their property Equity Financing?

- Credit rating

- Household worthy of

- Financial equilibrium

- Money and you may a job record

- Debt burden

You can examine with your financial to many other qualification assistance. Instance, of several require you to possess about 20% equity of your home before you can refinance.

Refinancing Alternatives for Your home Guarantee Financing

After you refinance your property equity mortgage, your essentially take out a different mortgage to pay off the new dated you to. This new financing have a different interest rate, identity, and you may charges versus you to definitely it changes.

For many who preferred the bank to suit your totally new domestic collateral mortgage, you can test calling her or him about their newest refinancing alternatives.

Look around with assorted loan providers and you can contrast rates of interest and conditions. If you discover things ideal, pose a question to your original lender when the they match it. You’ll get finest terminology whilst still being manage to run a loan provider you already believe.

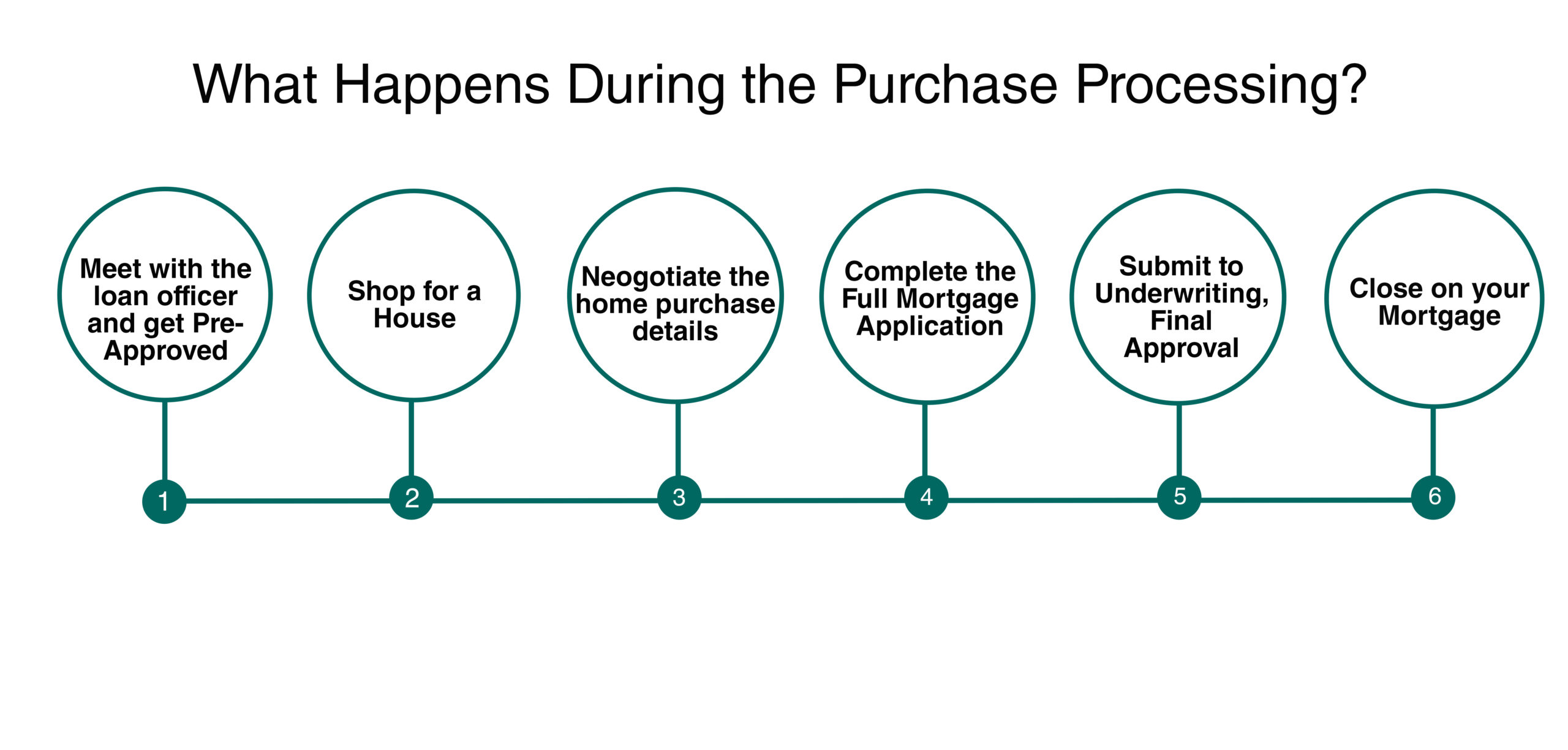

When you find a lender to partner with, you’ll want to make an application for the newest re-finance. As an element of this course of action, you’ll want to provide papers one to proves you make enough currency to make the month-to-month costs. You will probably should also get household appraised making sure you really have sufficient collateral.

After you have eligible for a loan, decide what type of refinancing you need. Widely known systems are a property collateral mortgage loan modification, a separate domestic guarantee financing, and you may a mortgage consolidation.

Home Guarantee Mortgage loan modification

A home guarantee loan mod changes the initial terms of the mortgage arrangement. Including, you’re able to find a lower life expectancy rate of interest or increase along the loan you convey more day to invest it off.

Rather than almost every other re-finance possibilities, a home guarantee mortgage loan modification has no need for you to definitely sign up for a different mortgage. This can be useful for those who have a reduced credit score or not enough household equity to qualify for a good refinance. Yet not, the financial institution possess a straight to refuse your application.